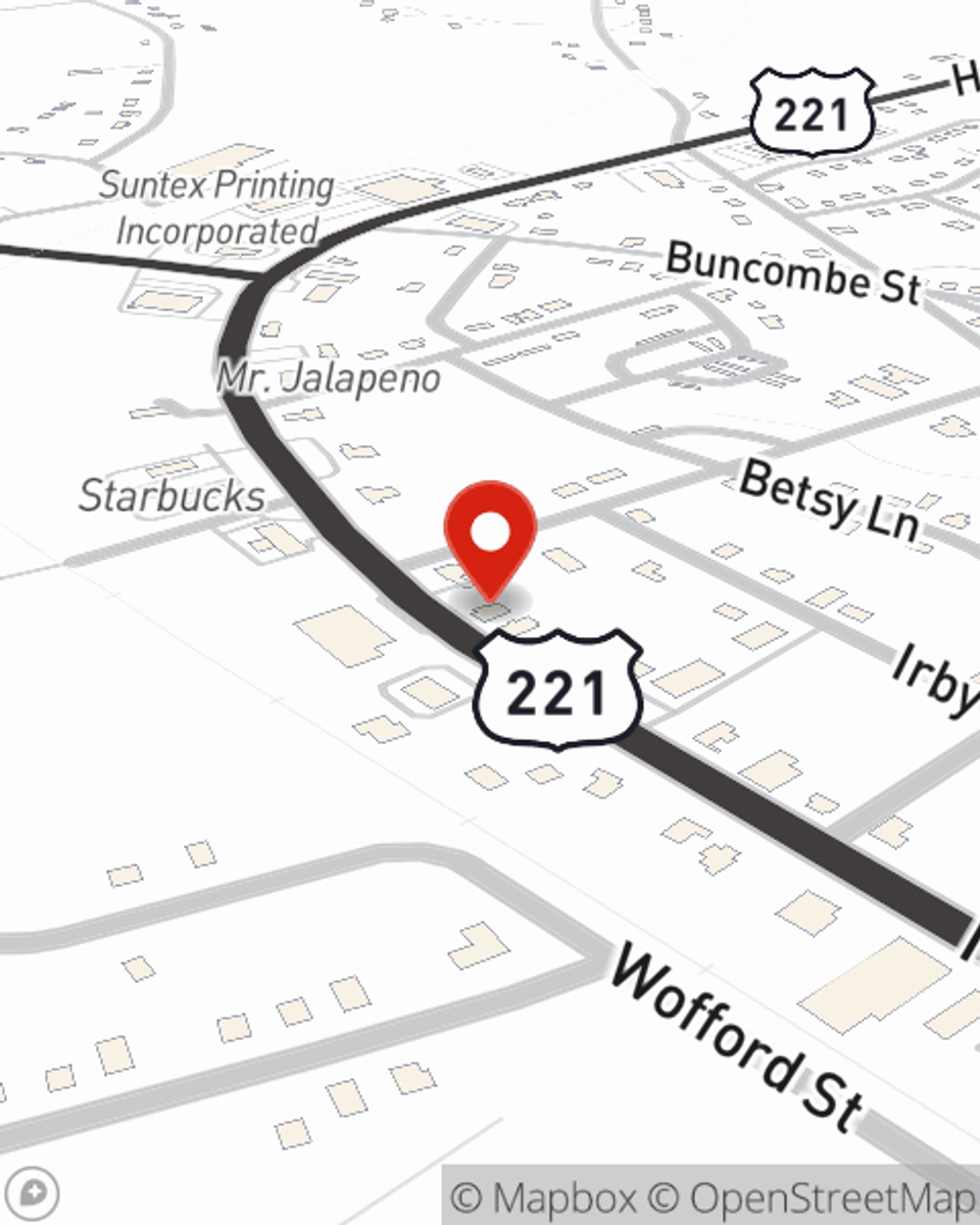

Life Insurance in and around Woodruff

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

- Greenville

- Travelers Rest

- Greer

- Simpsonville

- Fountain Inn

- Reidville

- Marietta

- Spartanburg

- Inman

- Berea

- Duncan

- Boiling Spring

- Roebuck

- Moore

- Laurens

- North Carolina

- South Carolina

- Georgia

It's Never Too Soon For Life Insurance

Buying life insurance coverage can be a lot to think about with many different options out there, but with State Farm, you can be sure to receive caring compassionate service. State Farm understands that your main purpose is to help provide for the people you're closest to.

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Life Insurance You Can Trust

When it comes to selecting what will work for you, State Farm can help. Agent Mike Livesay can assist you as you take a look at all the factors that go into the type and amount of insurance you need. These components may include your current age, your health status, and sometimes even occupation. By being aware of these elements, your agent can help make sure that you get an appropriate policy for you and your loved ones based on your unique situation and needs.

It's always a good time to make sure your loved ones have coverage against the unexpected. Call or email Mike Livesay's office to explore how State Farm can help cover your loved ones.

Have More Questions About Life Insurance?

Call Mike at (864) 788-5253 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Mike Livesay

State Farm® Insurance AgentSimple Insights®

Life insurance vs annuities

Life insurance vs annuities

Staying informed about how annuities and life insurance work makes it easier to come up with a financial roadmap that's tailored to your needs.

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.